Spain's GDP up 3.8 %

Thursday, November 23, 2006

One more example of the thriving Spanish economy, and the effects of booming tourism growth.

Spanish gross domestic product in the third quarter grew 0.9 percent from the second quarter and 3.8 percent on the year, according to data released Wednesday by the National Statistics Institute.

Spain's economy is one of the Europe's fastest growing for over a decade, due primarily to strong internal consumption and 'Bubbling' housing market. The IBEX, Spain's stock market, is one of the top world performers in developed countries, and should bring even more promise to all South European Economies.

Other European stories:

A New Labor Law for Europe?

The European Commission will debate minimum rights for non-standard workers and how labor laws should reflect the changing definition

The European Commission will on Wednesday (21 November) launch a public debate on whether the EU needs new labour laws to define a 'worker' in the EU or minimum rights for workers with non-standard contracts.

In Business Week, read the rest here

posted by IntoBlogs @ 9:03 PM,

,

![]()

NYSE, Euronext bid gaining approval

Tuesday, November 21, 2006

The Euronext / NYSE merger seems each week closer, and looks like it won't take many more weeks for us to see the deal being closed.

Europe: NYSE sees Euronext bid gaining approval

"We're hoping in a couple of weeks that will be clarified for everybody," Chai said at an investor conference in New York that was broadcast on the Internet. "Ultimately, I do think we'll get there. I don't think that will slow us down."

NYSE Group plans to schedule a shareholder vote next month on its cash-and-stock bid for Euronext, which is now valued at $13.6 billion. Deutsche Börse's decision to withdraw its bid for Euronext on Wednesday cleared the way for NYSE Group.

...

posted by IntoBlogs @ 2:43 AM,

,

![]()

Euro-zone growth slowed

Thursday, November 16, 2006

The economy in the EU euro-currency area grew by 0,5% in the last quarter, below the forecast of 0,7% and down from 0,9% in the second quarter.

We had less than expected growth in Germany and Italy, and grow in EU seems to have peaked, for this year at least, even if it is without rising inflation, that is expected to be 2,5% this year.

But since we live in a global economy, the performance of the U.S. economy in this next quarter will eventually boost Europe's growth. So the slowing growth is somewhat related to a more global slowdown in the economy.

The big surprise (or maybe not) is the fact that Spain remained even in the last three quarters with a 0,9% growth in each, maintaining the relatively strong GDP figures.

No big news here since Spain is now being chosen by international investors for the great performance of their markets, and is sided in performance with China.

posted by IntoBlogs @ 1:51 AM,

,

![]()

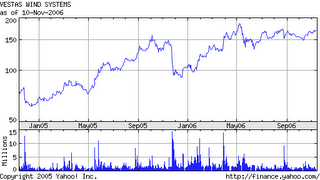

Vestas Wind Systems

Monday, November 13, 2006

Vestas Wind Systems is one of the biggest in wind power industry, Denmark-based company

engaged primarily in the development, manufacture, sale, marketing and maintenance of wind power systems that use wind energy to generate electricity. Its product range includes land and offshore wind turbines capable of generating between 850 kilowatts and 4.5 megawatts as well as Supervisory control and data acquisition (SCADA) products. This Company is operating internationally.

With a record growing wind energy market in 2005 and probably beating that record this year, Vestas Wind Systems is not only turning profitable this year, but is showing a greater expansion to big market-potential countries like China

Gary Greenberg, a global-investing specialist, recently named Vestas Wind Systems as on of the companies with the most promising alternative-energy technologies.

The current stock-market value might be well priced but if we look into the long-term potential of this company along with the rising net profit margin there is a strong probability that the stock will continue to trend higher in the next months.

posted by IntoBlogs @ 11:56 AM,

,

![]()

Portugal Set to Install 48 Windfarms

2005 was a record year in wind energy growth

In terms of new installed capacity in 2005, the US was clearly leading with 2,431 MW, followed by Germany (1,808 MW), Spain (1,764 MW), India (1,430 MW), Portugal (500 MW) and China (498 MW). This development shows that new players such as Portugal and China are gaining ground.

Portugal seems to show some promise in wind and solar energy growth for the next years.

In the news:

The Eolicas de Portugal consortium, in which ENDESA owns a 30% stake, has won the Portuguese government's concession to install windfarms with a total capacity of 1,200 MW. The Eolicas de Portugal project entails investment exceeding Euro 1.5 billion [US$1.9 billion] between 2006 and 2011 and the installation of 48 windfarms with capacity of between 20 and 25 MW at a variety of sites throughout Portugal.

The Eolicas de Portugal project will generate over 1,800 new jobs, and involve the development of an industrial estate in Viana do Castelo with a planned total surface area of 135,000 square meters. The facility will consist of the production facilities required to guarantee the integral production of a new ENERCON wind turbine model, the E-82, for the consortium, with a production capacity of 180 wind turbines/year and 600 poles/year.

Full article here

The countries with the highest total installed capacity are Germany (18,428 MW), Spain (10,027 MW), the USA (9,149 MW), India (4,430 MW) and Denmark (3,122).

posted by IntoBlogs @ 11:37 AM,

,

![]()

Spanish Stocks Boom

Thursday, November 09, 2006

There is an on-going real-estate boom in Spain, that we have already talked about last week in this blog.

Investors aren't missing any opportunities and are pushing prices higher, not only in properties but in the country's stock market. And with a reason, with an economic growth forecast of 3.7% this year, Spain is on the lead of the developed European Union countries.

"There is an aggressive capitalist spirit running through many Spanish companies," says Robert Tornabell, a banking and finance professor at ESADE Business School in Barcelona. "And it is pushing them to enter Europe and buy."

Madrid's Ibex 35 index performance is now above 30%

European Trading will continue tracking the Spanish markets, meanwhile check the Business Week article

posted by IntoBlogs @ 5:25 PM,

,

![]()

Germany's DAX composite

Germany is the biggest economy in the EU, with the highest % GDP in Europe and an excelent performance in the stockmarket this year.

Although the DAX index generally follows the US markets, it's still one of the indicators that Europe's economy is growing, leaving behind some of the worse years during the recession.

Germany companies are the best example for anyone who wants solid returns with established and known companies in the whole world, but the best but risky performance probably comes from Eastern Europe's Emerging Economies.

We will review some of the best German companies along with their stock market returns. Check it here in the European Trading Blog.

posted by IntoBlogs @ 12:43 AM,

,

![]()

European News

Some Europe News:

EU rebukes Turkey but will not suspend membership talks

The European Commission issued a critical report on Turkey Wednesday, stopping short of suspending EU membership talks now but telling Ankara to make progress on Cyprus within five weeks.

"The commission will make relevant recommendations ahead of the (14-15) December European Council (EU summit), if Turkey has not fulfilled its obligations," the European Union's executive arm said in its report.

...

posted by IntoBlogs @ 12:34 AM,

,

![]()

NYSE and Euronext merger

Tuesday, November 07, 2006

The New York Stock Exchange (NYSE) has agreed to buy the pan-European Euronext exchange, creating the first transatlantic stock market and possibly opening up the idea of new mergers and the possibility of a new global exchange.

What are the gains to the causal investors? The changes to the products offered, the infrastructure or the innovations?

There are still many questions regarding the practical effects in the global capital markets, but surely there is still much to be talked about.

European Trading will update and comment more on this subject as soon as the events of the merger come in in the next weeks/months.

Meanwhile here is one of the first news articles of the whole announcement: BBC News | Business

posted by IntoBlogs @ 4:10 AM,

,

![]()

Europe's ETF

Saturday, November 04, 2006

... There has been a proliferation of ETFs in Europe to the point where they now outnumber the ETFs in the US ...

This is topic about ETFs that track European Stocks and Markets.

I'm still working on a list of these products that are traded in European Financial Markets like Euronext, but there are already plenty of these easily tradable stocks in NYSE and NASDAQ stock markets.

European ETFs are the best choice to make small investments in diversified Euro Stocks, and with even lower costs than the usual investment funds available at so many Europe's Banks.

In case you are still confused, ETFs are stocks that track a specific index or group of stocks, industries or even commodities.

For more information about ETFs check out the Wikipedia entry: http://en.wikipedia.org/wiki/Exchange-traded_fund

Or check ETF Trends, with comprehensive news about European ETFs:

ETF Trends Europe

Here is a small ETF list of European Markets:

iShares S&P Europe 350 Index (ETF) (Public, NYSE:IEV)

BLDRS Europe 100 ADR Index (ETF) (Public, NASDAQ:ADRU)

iShares MSCI Sweden Index (ETF) (Public, NYSE:EWD)

Europe 2001 HOLDRS (Public, AMEX:EKH)

Vanguard European ETF (Public, AMEX:VGK)

iShares MSCI Belgium Index (ETF) (Public, NYSE:EWK)

iShares MSCI France Index (ETF) (Public, NYSE:EWQ)

iShares MSCI Germany Index Fund (ETF) (Public, NYSE:EWG)

iShares MSCI United Kingdom Index (ETF) (Public, NYSE:EWU)

Find more ETFs in MSN Money ETF list

posted by IntoBlogs @ 1:37 AM,

,

![]()

AMD's help from Europe

Thursday, November 02, 2006

Afterall there are still many reasons not to offshore 'hitech' jobs outside of Western Europe. One of these stories comes from AMD and Germany:

AMD's Secret Weapon: Dresden's Skills

The U.S. chipmaker has enjoyed big success since moving to Germany, where highly skilled workers keep innovation and efficiency high

AMD, Dresden

Intellectually Competitive Edge

The ability of AMD's 3,000 workers in Dresden to ramp up production of new chip designs quickly has been crucial in allowing AMD to gain ground on chip giant Intel (INTC). AMD has boosted its share of the market for desktop and workstation microprocessors to 27% from 18% a year ago, according to Arizona-based Mercury Research.

Read the full article here

posted by IntoBlogs @ 8:48 PM,

,

![]()

Ascari European Race Car

Wednesday, November 01, 2006

Ascari, the same company that is creating the fastest car in the UK, have revealed details of their newest project. Called the A10, this is a 600 bhp, road-going version of Ascari's Spanish GT Race Car.

So far, a single yellow example has been completed and is being extensively tested before the regular production version is revealed in 2006. Engineers at Banbury, and the exclusive Race Resort Ascari racetrack, are committed to ensuring this 220mph supercar delivers world-class performance similar to other independents such as Pagani, Koenigsegg and Mosler.

Power will come from a modified BMW M5 engine with a six speed manual as standard or a sequential gearbox available as an option. With its wide carbon fibre body and matching fixed rear wing, the A10 more dramatic compared to the KZ1 it's based off.

You can read more about this on BusinessWeek's article Europe's Newest Supercar

And Concept Carz info.

--- In The European News:

British Report Backs More Carbon Trading

Commissioned by Britain's government, an economist's report on climate change calls for the global expansion of the European Emissions Trading Scheme

The European Emissions Trading Scheme (ETS) should be expanded on a global scale, according to a landmark UK report on the costs of climate change that also calls on the world to act now or face dire consequences

...

---

Deutsche Bank's 3Q Profit Rises

By MATT MOORE AP Business Writer

© 2006 The Associated Press

FRANKFURT, Germany — Deutsche Bank AG said Wednesday that its third-quarter net profit rose by 25 percent, helped by gains that included an insurance settlement related to the Sept. 11 terrorist attacks, even as its trading revenue fell.

Germany's biggest bank earned euro1.24 billion (US$1.57 billion) in the July-September period, compared with euro991 million a year earlier, better than the euro1.04 billion (US$1.32 billion) that analysts polled by Dow Jones Newswires had expected

...

posted by IntoBlogs @ 1:44 PM,

,

![]()